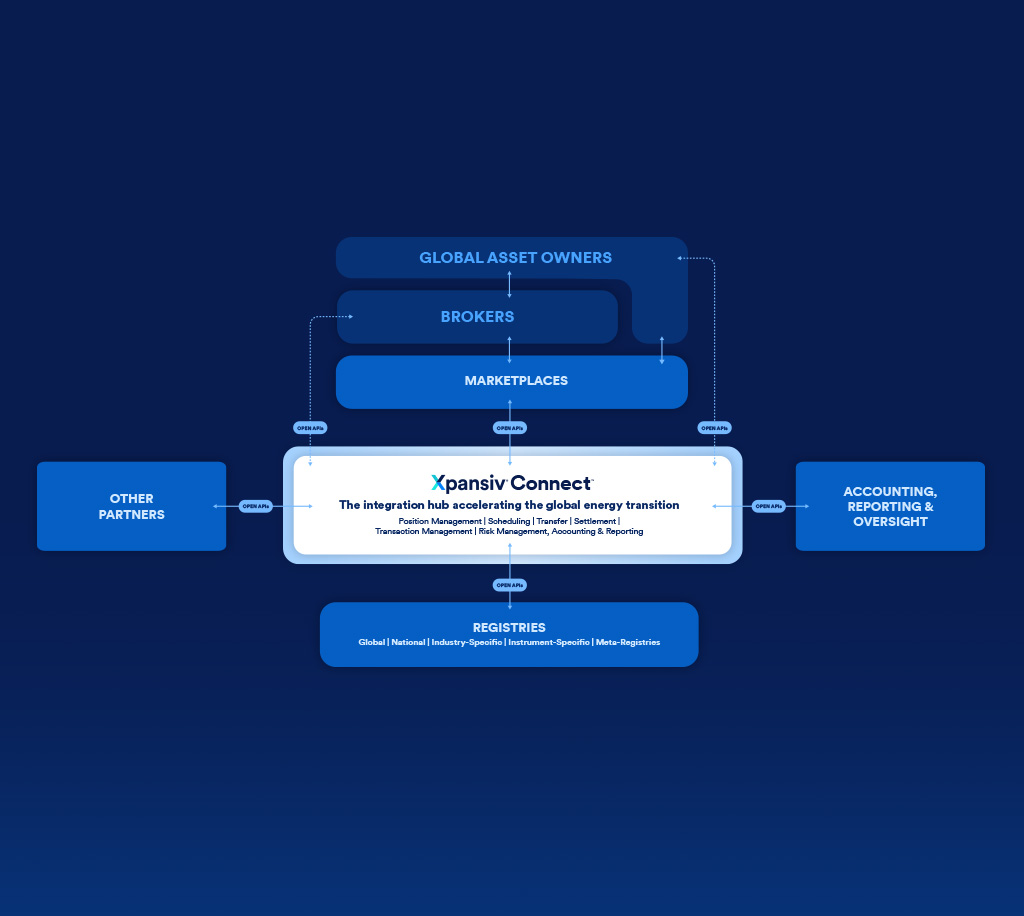

Xpansiv Connect provides all market participants with seamless, direct access to automated settlement and portfolio management features integrated with leading global registries, marketplaces, and a worldwide network of thousands of market end users and intermediaries.

Through its comprehensive suite of open APIs, Xpansiv Connect provides seamless access to key operations, liquidity and data pools, streamlining and standardizing workflows across global environmental commodities markets.

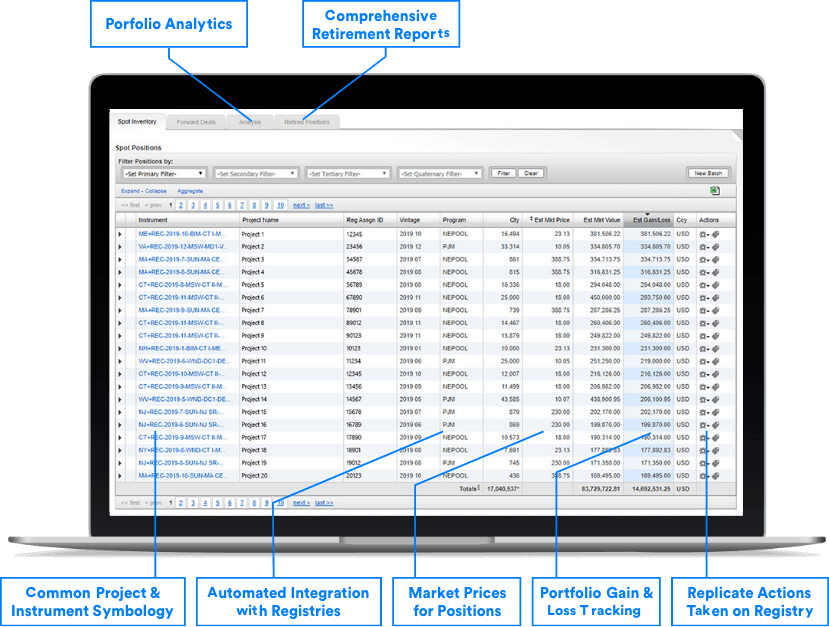

Centralized Management of Environmental Commodities Across Registries

Xpansiv® Connect™ Registries

This screen shot shows the Consolidated Account view. Note how simple it is to see your position across disparate registries, and how it brings everything together so you can manage and schedule your entire environmental portfolio from one user-friendly utility.

Xpansiv® Connect™:

- ACR

- Climate Action Reserve (CAR)

- EcoRegistry

- Electric Reliability Council of Texas (ERCOT)

- Evident.

- New England Power Pool (NEPOOL)

- North American Renewables Registry (NAR)

- North Carolina Renewable Tracking System (NC-RETS)

- New York Generation Attribute Tracking System (NYGATS)

- Michigan Renewable Energy Certification System (MIRECS)

- Midwest Renewable Energy Tracking System (M-RETS)

- PJM Environmental Information Services (PJM EIS)

- Verified Carbon Standard (Verra)

- The International Tracking Standard Foundation (I-TRACK)

- Tradable Instrument for Global Renewable (TIGR)

Customers and

Partners include:

- Sustainability Teams

- Project Developers

- Trading Firms, Banks

- Market Intermediaries

- Registries, Data Providers

- Environmental Accounting Systems

- Energy Trading Risk Management (ETRM) Systems

- Platforms/Exchanges

- Ratings Agencies

Open APIs provide access to modular liquidity, settlement, portfolio management, and data platforms, enabling expedited time to market with proven technology and seamless interoperability.